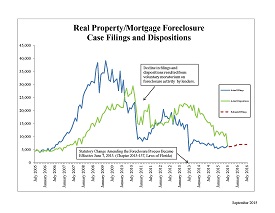

One of the many problems caused by the national mortgage foreclosure crisis from the last decade was the explosion in the number of foreclosure filings in Florida state courts. According to statistics published in a recent article on the Florida Courts (www.flcourts.org) website, the number of foreclosure filings rose to around 400,000 cases at the height of the crisis, as compared to the normal average of 70,000 or so in an average year.

This jump in filings caused a backlog that topped 300,000 cases in June of 2013. That is why virtually all foreclosure cases over the last 5 to 6 years have experienced many months and even years of delays working their way through our state court system. As of September of 2015, that back log amount has been reduced below 80,000 cases.

To read the entire article go to: http://www.flcourts.org/administration-funding/court-funding-budget/mortgage-foreclosure.stml

What does this mean to you if you are facing foreclosure right now? It means that your lender is most likely going to push harder and faster to try and seize your property, and get you removed from the premises. Gone are the days when you could stay in your property for years while the courts tried to figure out what to do with you. In addition, much of the leniency that was afforded to struggling home owners 5, 6 and 7 years ago has gone away.

You need to contact an attorney who specializes in defending your rights before it is too late. Many of the banks and other loan servicers have made it clear that they want your mortgage payments on time, and in full, or they will push for foreclosure in short order. They are also much tighter on granting mortgage modifications than they were back then, as well.

Before your lender takes your home, you need to talk with attorneys who are knowledgeable about keeping your home out of foreclosure. Korte & Wortman, P.A. will fight for your rights against any bank, loan servicer or their attorneys. The earlier you get us involved in your defense, the better chance we have of helping you keep your home.

Contact us at Korte & Wortman now. Check out our website to see our results: working with our clients to help them stave off foreclosure and save their homes by getting them the mortgage modifications and/or foreclosure defense they need. Check out a few of our many success stories on our website at http://foreclosurefactor.com/results/loan-modification-results/.